As in many other countries, women in Switzerland generally receive lower pensions than men. The difference for statutory state pensions is minimal, according to a 2016 study by the Federal Social Insurance Office, with old age and survivor’s insurance pensions showing a gender gap of just under 3 percent.

But the cleft reaches a whopping 63 percent in occupational pensions – the second of Switzerland’s three pillar pension system, and an average 54 percent in private pensions – the third pillar.

Better position of women in statutory state pensions

On average, women and men receive a similarly high state pension. This is due partly to splitting: to calculate a pension, the incomes of both members of a married couple are combined, with both partners credited with half each. In addition, child-rearing credits – notional income during the years when children are dependent on care – are granted. Together, that means any gender differences during partners’ periods of employment mostly balanced out.

Women draw 57 percent of state pensions, but pay only 33 percent of contributions. Additionally, widows are treated more favorably than widowers. While widowed women are entitled to a pension even after their children have reached the legal age of majority, widowed men are entitled to a pension only while they have children of school age. Thus some 97 percent of this category of pensions go to women.

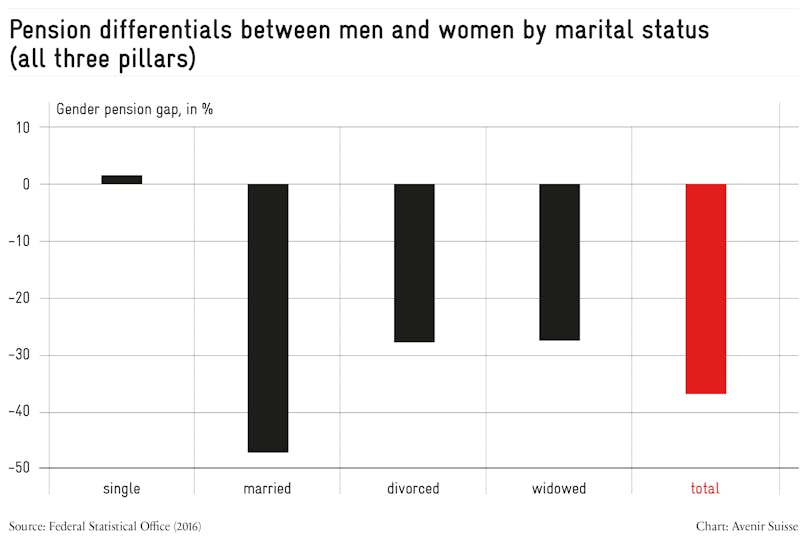

Pension gaps in the second pillar are not always noticeable

At an average of more than CHF 18,000 a year, the gender difference in the 2nd pillar is significant. But it should be considered in a differentiated way. Tap does not always imply female pensioners are financially worse off than men. In the case of unmarried pensioners, for example, there seems to be practically no difference (see chart). Widowed and divorced pensioners may have a below-average gender gap, but the risk of poverty in older age is comparatively high, especially among the latter group. Nearly one in three divorced female pensioners receives supplementary benefits – but also widowed and unmarried people are more often dependent on financial support than married couples.

This is probably due to the fact that living in a single household involves higher fixed costs per capita than as a couple. Since women have a higher life expectancy than men and are often younger than their partners, more widows tend to live longer than widowers, and therefore more often become dependent on elderly care. Interestingly, the gender gap in pensions is highest within married couples – though in many cases, it is likely to be barely noticeable for women, since most married couples pool and share their incomes. The question whether the two pensions will be enough to live on is more important than who contributes how much. In addition, households comprising couples benefit from lower fixed costs – especially in terms of housing.

In recent decades, the pension system has undergone various adjustments to narrow the gender pension gap. One example is the introduction of pension equalization in the second pillar: in case of a divorce, for example, pension entitlements in the pension fund are balanced out between the two partners, primarily benefitting women who were hardly or not at all employed during the marriage (similar to splitting in state pensions). So the pension gap between the sexes will continue to narrow in future even without additional measures.

Different career biographies, different pensions

Even though female participation in the labor market has increased sharply, the career biographies of women and men still differ considerably. Women continue to work part-time far more than men. The workload has a particularly strong impact on future pension levels, especially for occupational pensions: Those who work less have lower incomes and, accordingly, can put less aside in terms of retirement capital.

This problem is further intensified by the so-called “coordination deduction.” In the second pillar only the portion of salary exceeding CHF 24,885 is covered. This means that savings contributions fall overproportionally when the workload is reduced: if a woman earns CHF 80,000 on a full-time job, a salary of CHF 55,115 counts as the basis for building up her retirement capital. However, if she reduces her workload to half-time working (and thus still earns CHF 40,000) the relevant income for the occupational pension plan is not halved, but cut to CHF 15,115 due to the fixed coordination deduction.

Third pillar is less popular with women

Women also accrue lower independent pensions savings than men in the third pillar (the so-called “3a”). Only one in two working women regularly invest in the third pillar, while the corresponding rate for men is almost 60 percent, according to a Credit Suisse study. The amounts dedicated to the 3a scheme depend primarily on salary, meaning the probability and the amount of payment both increase as salary rises.

Despite the fact that women’s salaries tend to be somewhat lower, other factors also play a role. A large proportion of young, unmarried women with high workloads and sufficient financial resources still refrain from building up retirement assets in pillar 3a, even though they could afford to make at least small regular payments. The CS study concluded that both young women and childless women in dual-earner households in particular could do more for their private pension provision.

Reduce the pension gap thrice over

What measures could possibly further reduce the gender pension gap in future?

Barriers preventing women working more should be removed. A higher level of employment and fewer career interruptions would lead to better financial security – both in working life and old age. The Swiss tax system is also an obstacle to the expansion of women’s employment. The joint tax assessment of married couples is an incentive for married women not to be employed at all, or to be employed only for short hours or brief stints. With the introduction of individual taxation, such negative incentives could be reduced (while, incidentally, employment could rise by up to 60,000 full time jobs. Pension differences could also be reduced by lowering the coordination deduction in the second pillar. A large number of employers have already responded. As an evaluation by Swiss Life shows, around 70 percent of SMEs already link the level of the coordination deduction to the workload, or do without it altogether. A similar picture is presented in a separate Swisscanto study. However, a lower coordination deduction is associated with higher ancillary wage costs, which in turn could lead to lower net wages or even lower demand for labor.

Finally, women are particularly well advised to deal with their own retirement provisions sooner rather than later. Avoiding gaps in provision, private saving in pillar 3a or the choice of employment model can have a significant influence on the size of future pensions. What our financial situation will look like in old age is in our own hands, too.