Almost eight months have passed since Avenir Suisse on March 9 discussed the IMF’s regular GDP forecasts and calculated the enormous economic downswings suffered by various countries since the start of the 2008 financial crisis.

But by then, the next crisis was on the way – Corona. Covid-19 took hold in Europe in March, reached the US inin April and extended its way to South America and India.

The epidemiological part of the crisis is not over yet: after a relatively quiet summer, Europe is now suffering a second wave, whose outcome remains uncertain. The pandemic will probably not end until an effective vaccine is developed.

Nor have the economic consequences been overcome either.

The GDP forecasts at the level of country groups

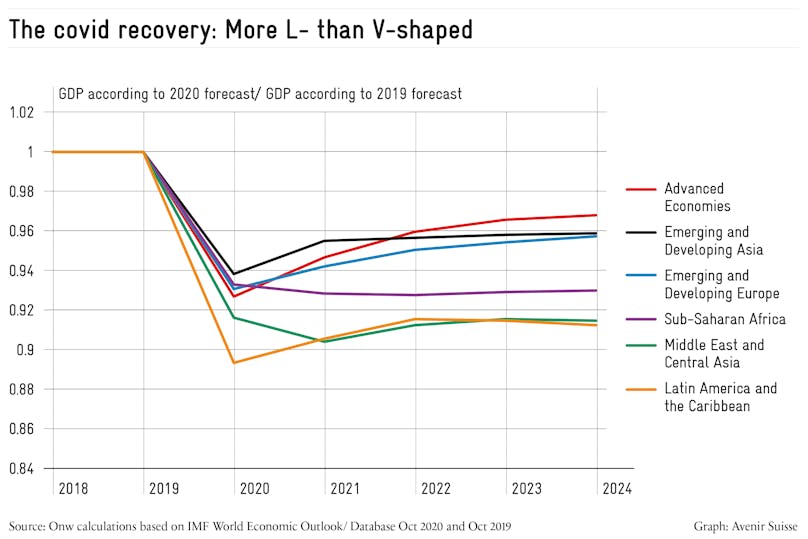

In October, IMF experts tried to estimate the course of growth and other key indicators. Compared to the their previous year’s forecasts, the losses on an international average for 2020 amount to between 6 percent and 10 percent of GDP, depending on region (see Figure 1). The further course of events is unclear. Corona is a classic exogenous shock from which an economy would have to regain its old growth path relatively quickly. That would suggest the gaps that have opened compared with the 2019 forecast will close quickly in subsequent years.

Unfortunately, matters are not that simple. An external crisis can lead to a chain reaction with negative effects on the economy and society that are hard to predict. The most obvious risk is public debt. Many countries were already overburdened at the start of the pandemic – and from this position had to shoulder a collapse in revenues as well enormous additional public spending.

Possible national bankruptcies could in turn have repercussions for other countries. Political stability and social peace are threatened by such crises as they form a breeding ground for political polarization, unrest or even upheaval: the IMF underestimated such chain reactions amid the financial crisis, as shown by the superimposed forecast curves for Greece (can be selected in the interactive Figure 2).

Since then, the IMF appears to have refined its models and increasingly taken institutional interdependencies into account: Although it now forecasts a certain catch-up process in the wake of the Corona collapse, none of the six country classes is expected to make up for significantly more than half of the 2020 collapse by 2024 (Figure 1). Globally and aggregated over these five years, the losses in value add up to the astronomical amount of 24.4 trillion – or 24,400,000,000,000 USD.

Country differences are substantial: A V-shaped (ie. rapid) recovery is forecast for developed economies (large parts of Europe, including Switzerland, the USA, Canada, Israel, Japan, South Korea, Singapore, Hong Kong, Taiwan, Australia and New Zealand). This group is expected to close slightly more than half of the forecast gap by 2024.

The countries should be followed closely by emerging European states and (China-dominated) East Asia, where the post-financial crisis slump was the smallest, at 6 percent, by 2020.

By contrast, an almost perfect L-shape is predicted (on average) for the developing and emerging countries of Africa, the Middle East, Central Asia, and Latin America and the Caribbean. Compared to the previous year’s forecast, they will barely compensate for the Corona-related slump in coming years. This supports the thesis that the danger of negative chain reactions is higher in countries with weaker political institutions than in those with strong ones: wherever conflicts have been smouldering for some time, Corona could be the spark to set off real conflagrations.

The GDP forecasts for 25 individual countries

For the analysis of the IMF forecasts at the disaggregated level, the same approach is used as in our March 9 blog. Ten IMF forecasts covering the past 12 years on the development of GDP per capita are superimposed. To allow for a good comparison, (inflation-adjusted) GDP is indexed to 2007 – i.e. just before the outbreak of the financial crisis – in the interactive charts. The data in the graph correspond to the forecast date of the respective GDP line. There are 25 countries to choose from, whose economies are either particularly important or show particularly exciting patterns in the forecast changes. From these, one can compile one’s own country comparisons.

Figure 2: The IMF forecasts from 2008 to 2020 for 25 countries

Reading example:

Clicking on the forecast date “April 2008”, the red curve shows GDP growth until 2008 and the growth forecast at that time for the following five years. Clicking then on “April 2009”, highlights the revised growth curve The difference between the dark blue and the purple curve shows the effects of the Corona crisis.

Source: Own calculations based on the IMF World Economic Outlook Database April 2008 to October 2020

A look at these, mainly large, 25 economies shows that there is hardly a country that has not experienced a significant collapse in growth because of the Corona crisis – as was the case during the financial crisis in 2008. On the other hand, in many places the slump in GDP is not significantly greater than during the financial crisis. The disparity prompts a few specific observations:

- The recession predicted for Switzerland by the IMF is more of L-shaped than V-shaped. There has been no change in the weak growth diagnosed seven months ago – it is now simply taking place a few percent further down the road. Switzerland is not expected to reach the per capita GDP forecast for 2020 by 2025.

- Greece’s GDP per capita in 2020 will be just 72.4 percent of the 2007 level. On the projected growth path, it would take until 2036 for Greece to return to 2007 levels.

- Italy is almost as badly off as Greece. In 2020, GDP per capita is projected to be 83.3 percent of 2007 levels and growth momentum is weak.

- Spain and Portugal, by contrast, should make up for their major declines relatively quickly.

- For Ireland, the forecasts have so far not been worth the paper they were written on. The national accounts of this tax haven have so far shown strange results. The Covid slump should soon be made up for.

- In Brazil, Covid has led to a deepening of the previous economic crisis.

- Mexico is predicted to suffer a major slump without any subsequent tendency to catch up.

- China’s growth curve has long since disappeared off the scale According to the IMF, per capita GDP this year is expected to be 3.7 percent% below the figure forecast last year. Thus, China loses only half a year of economic growth.

- India’s GDP is suffering an enormous slump. Compared to last year’s forecast, a loss of 16.2 percent is predicted for 2020, which is hardly expected to decrease in the following years. However, since India is showing very high trend growth, this means that the country is only three years behind in growth.

- Nigeria is continuing the misery suffered since 2015. From the African “lion state” (following the example of the Asian tiger states) to its “coma patient”: Nigeria is the only one of the 25 economies examined for which the IMF forecasts permanent zero growth in the aftermath of the Corona crisis.

- A similar tragedy may well occur in South Africa.